Recently Fraser Property caught my attention because of their NAV.

However, I also look out for, minimally:

- Total Revenue

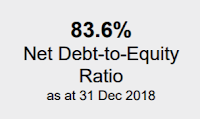

- Net Debt to Equity Ratio

Their Total Revenue is quite promising. Growing YoY.

But the Net Debt to Equity Ratio is on the higher end compared to Capitaland.

Meanwhile Capitaland:

Would you buy Fraser Property?

Good buy?

Or Good bye?